![The Art of Budgeting: Your Guide to Financial Success [October 2023]](/_next/image?url=%2Fimages%2Fblog-images%2Fbuild-a-budget.jpg&w=3840&q=75)

Budgeting—it's a word that can strike fear into the hearts of many. It sounds restrictive, boring, and just plain no fun. But hold on a second! Budgeting doesn't have to be a buzzkill. In fact, it can be your ticket to financial freedom and peace of mind. In this guide, we're going to break down the art of budgeting into easy-to-digest components and show you how to make it work for you.

Why Budgeting Matters

Before we dive into the nitty-gritty of budgeting, let's talk about why it's so darn important. Budgeting is like the roadmap for your finances. It helps you:

-

Control Your Money: Ever wondered where all your money disappears to each month? A budget helps you keep tabs on your cash flow.

-

Set Financial Goals: Want to buy a new car, go on a dream vacation, or retire early? Budgeting helps you allocate funds to reach those goals.

-

Reduce Stress: Financial woes can keep you up at night. A well-planned budget can ease your worries and give you peace of mind.

Now that we've established why budgeting matters, let's jump into the key components of a successful budget.

Component 1: Income Evaluation

First things first, you need to know how much money is coming in. Your income is like the fuel for your financial engine. Here's what to consider:

-

Gross vs. Net Income: Your gross income is what you earn before taxes and deductions. Your net income is what actually ends up in your bank account. Knowing both is crucial for budgeting.

-

Consistency: Is your income stable, or does it vary? If it's inconsistent, use an average to get a better picture.

-

Side Hustles: Don't forget income from side gigs or part-time jobs. Every dollar counts!

Component 2: Expense Tracking

Now, let's tackle your spending. This is where many people stumble, but it's vital for budgeting success.

-

Fixed vs. Variable Expenses: Fixed expenses like rent or mortgage are predictable. Variable expenses like dining out can fluctuate. Track them all.

-

Prioritize Essentials: Start by listing necessities like housing, utilities, groceries, and transportation. These come first.

-

Watch for Sneaky Expenses: Little purchases here and there add up fast. That daily latte might be draining your wallet more than you realize.

Component 3: Setting Goals

Budgeting without goals is like sailing without a destination. What do you want to achieve? Here are some goal-setting tips:

-

Short-Term vs. Long-Term Goals: Short-term goals might include paying off credit card debt. Long-term goals could be saving for retirement or a down payment on a house.

-

Specific and Measurable: Goals like "save more money" are vague. Instead, say, "save $5,000 for a European vacation by next summer."

-

Realistic and Achievable: Be honest about what you can achieve. Setting impossible goals can be demotivating.

Component 4: Expense Cutting

Now comes the tricky part—trimming the fat. It's time to identify where you can cut expenses.

-

Needs vs. Wants: Distinguish between what you need and what you want. Sacrificing wants can free up money for your goals.

-

Shop Smart: Look for deals, use coupons, and take advantage of discounts. Your budget will thank you.

-

Review Subscriptions: Are you really using all those streaming services, magazine subscriptions, and gym memberships?

Component 5: Emergency Fund

Life is unpredictable, and emergencies happen. That's why having an emergency fund is crucial.

-

Start Small: Aim for at least one month's worth of expenses initially. Gradually build it to cover three to six months of living expenses.

-

Separate Account: Keep your emergency fund separate from your regular checking and savings accounts to avoid temptation.

Component 6: Debt Management

Debt can be a budget killer, so it's essential to have a plan.

-

High-Interest Debt First: Prioritize paying off high-interest debts, like credit card balances. The interest on these can eat up your budget.

-

Snowball or Avalanche Method: Choose a strategy that works for you. The snowball method pays off the smallest debts first, while the avalanche method tackles the highest interest rate debts first.

Component 7: Monitoring and Adjusting

Your budget is not set in stone. It's a living document that should evolve with your life.

-

Regular Check-Ins: Review your budget at least once a month to ensure you're on track.

-

Adjust as Needed: Life changes, and so should your budget. If you get a raise, allocate some of it to your goals. If expenses increase, cut back in other areas.

-

Celebrate Milestones: When you achieve financial goals, celebrate your success. It keeps you motivated and makes budgeting feel less like a chore.

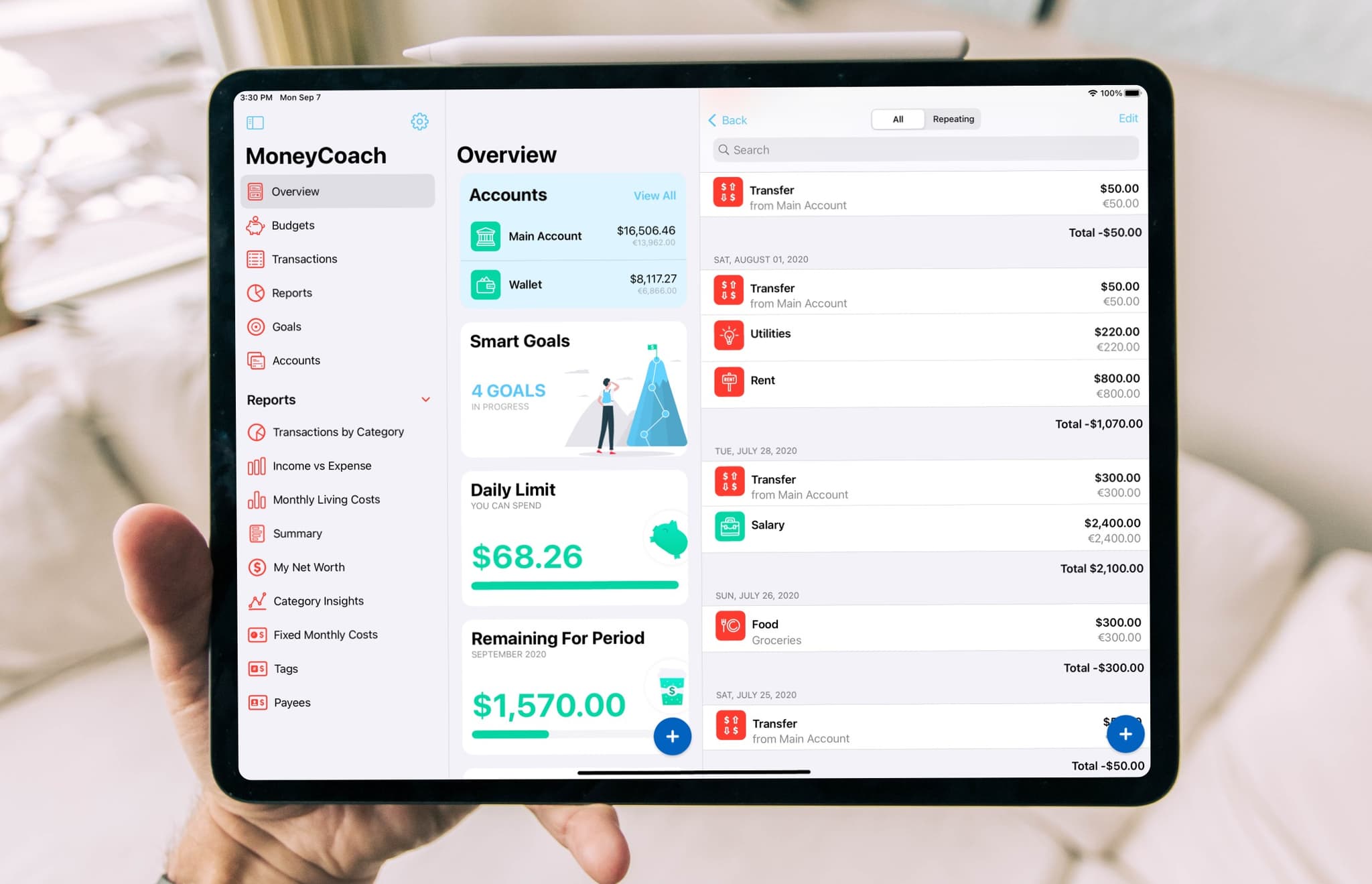

Component 8: Automation and Tools

Technology is your friend when it comes to budgeting. Use apps and online tools to make your life easier.

-

Budgeting Apps: There are countless budgeting apps available that can help you track expenses, set goals, and manage your money more effectively.

-

Automatic Transfers: Set up automatic transfers to your savings and investment accounts. This ensures you're consistently working toward your financial goals.

Component 9: Flexibility

Budgeting should improve your financial life, not make it rigid and stressful. Be flexible and forgiving with yourself.

-

Allowance for Fun: Don't forget to budget for fun activities and treats. Life should be enjoyed, not just endured.

-

Adjust Expectations: Sometimes, unexpected expenses pop up. It's okay to adjust your budget temporarily to accommodate them.

Component 10: Seek Professional Help

If budgeting feels overwhelming or you have complex financial situations, consider seeking help from a financial advisor or counselor. They can provide expert guidance tailored to your needs.

Wrapping Up

Budgeting doesn't have to be a chore or a source of anxiety. When done right, it's a powerful tool for achieving your financial dreams. Remember, the key components of successful budgeting are income evaluation, expense tracking, goal setting, expense cutting, emergency fund, debt management, monitoring and adjusting, automation and tools, flexibility, and seeking professional help. With these elements in place, you'll be well on your way to financial success and peace of mind.