Credit cards are a common and convenient way to pay for purchases. However, they can also be a double-edged sword, with potential pitfalls that can impact your finances if you're not careful. Here are some of the potential downsides of using a credit card:

1. High-interest rates

One of the most significant pitfalls of credit cards is the high-interest rates they can carry. If you don't pay your balance in full each month, you could end up carrying a balance and accruing interest charges. This can add up quickly and make it harder to pay off your debt in the long run.

2. Temptation to overspend

Credit cards can make it easy to spend beyond your means. The ability to make purchases without immediately seeing the impact on your bank account can be tempting, leading to overspending and potentially accumulating debt.

3. Fees

Credit cards can come with a range of fees, including annual fees, late payment fees, and balance transfer fees. These fees can add up and make it harder to manage your finances.

4. Impact on credit score

Your credit score is based on a range of factors, including your credit utilization rate, which is the amount of credit you're using compared to your total credit limit. If you have high credit card balances, it can negatively impact your credit score, making it harder to obtain credit in the future.

5. Fraud and identity theft

Credit cards are also vulnerable to fraud and identity theft. If someone gains access to your card information, they could use it to make unauthorized purchases, leaving you responsible for the charges.

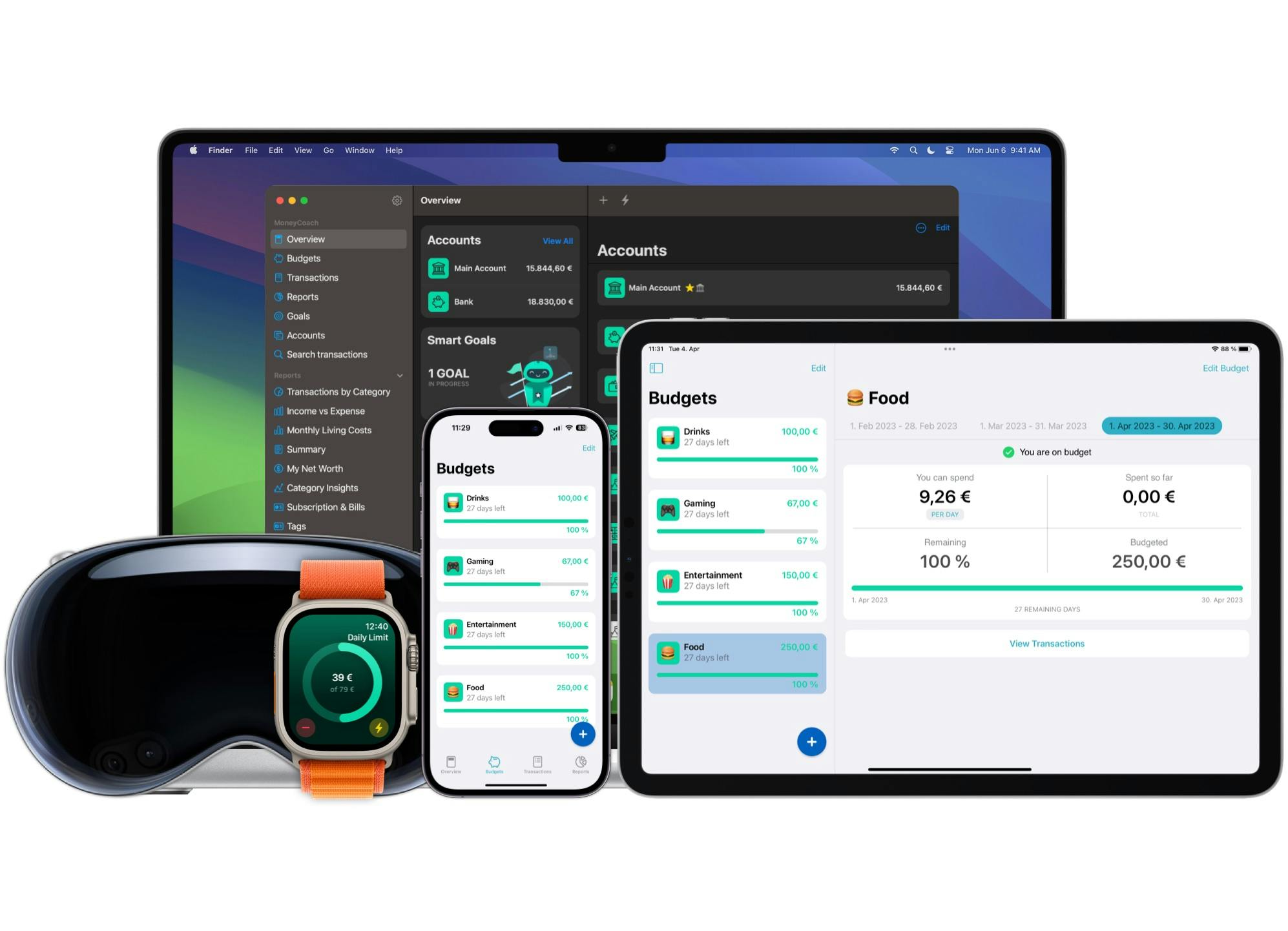

MoneyCoach now supports manual credit card tracking. Set up your credit cards and activate the payment due reminders so you never have to pay those nasty credit card interests.

While credit cards can be a valuable tool when used responsibly, it's important to be aware of these potential pitfalls and take steps to avoid them. This can include setting a budget, paying your balance in full each month, and monitoring your credit card activity regularly.