In today's world, many people are skeptical about the use of credit cards. With horror stories of high interest rates and massive debts, it's understandable why many would rather avoid credit cards altogether. However, credit cards can actually be incredibly useful for consumers, especially when used responsibly. Here are some reasons why using a credit card can be beneficial:

1. Building Credit History

One of the main advantages of using a credit card is the ability to build credit history. By using your credit card responsibly, such as making payments on time and keeping your balance low, you can establish a positive credit history, which can be useful when applying for loans or mortgages in the future. In fact, having a good credit score can even lead to lower interest rates on loans, ultimately saving you money in the long run.

2. Rewards Programs

Many credit cards come with rewards programs that allow you to earn points or cashback for your purchases. These rewards can be used to redeem discounts or free items, effectively giving you back some of the money you spend on your purchases. Some credit cards even offer additional perks, such as airline miles or hotel points, which can be redeemed for travel or accommodations.

3. Fraud Protection

Credit cards offer stronger fraud protection than debit cards or cash. In the event that your credit card is stolen or used fraudulently, you can quickly and easily report the activity and have it removed from your account. Additionally, many credit cards offer zero liability protection, which means you won't be held responsible for unauthorized purchases made on your card.

4. Convenience

Using a credit card can be much more convenient than carrying cash or writing checks. With a credit card, you can make purchases online, over the phone, or in-person without having to worry about carrying large amounts of cash or finding an ATM. Additionally, many credit cards offer features like mobile payments and contactless payments, making transactions even easier and more convenient.

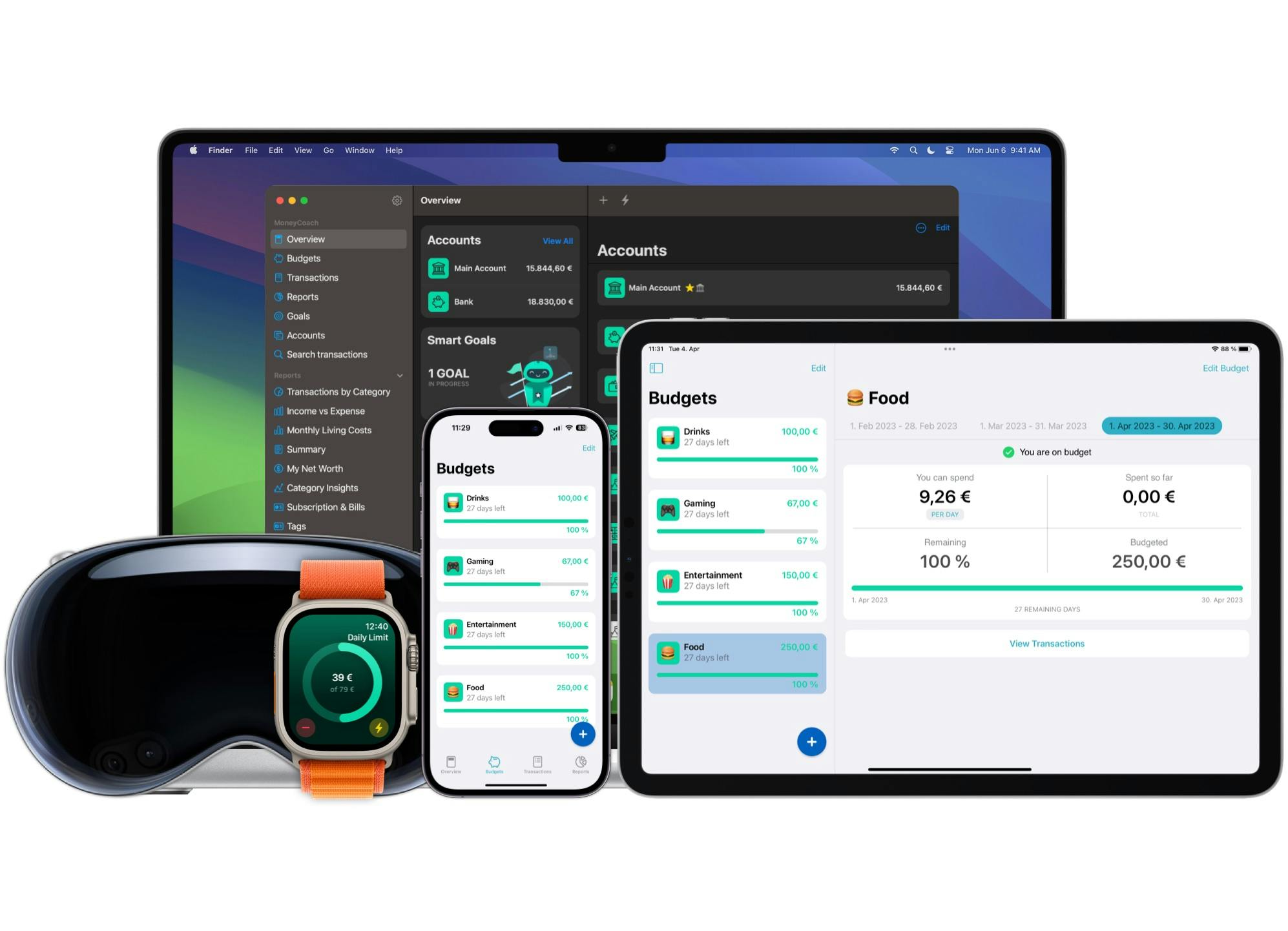

5. Budgeting and Expense Tracking

Credit cards can also be useful for budgeting and expense tracking. By using your credit card for your purchases, you can easily track your expenses and monitor your spending habits. Many credit card companies offer online tools and apps that allow you to track your purchases and create budgeting plans to help you manage your finances more effectively.

MoneyCoach now supports manual credit card tracking. Set up your credit cards and activate the payment due reminders so you never have to pay those nasty credit card interests. Learn how to manage credit cards in MoneyCoach.

In conclusion, credit cards can be incredibly useful for consumers when used responsibly. By taking advantage of rewards programs, building credit history, and using credit cards for budgeting and expense tracking, you can make the most of your credit card and improve your financial situation. Of course, it's important to remember that credit cards come with their own risks and responsibilities, so it's essential to use them wisely and avoid overspending or carrying a high balance.