As a business owner, managing your finances is paramount to your success. One of the most critical aspects of financial management is tracking your business expenses efficiently and accurately. In today's digital age, technology has provided us with tools and apps that make this process more streamlined than ever before. Among these tools is Apple Pay, a widely used digital payment system that can significantly simplify expense tracking for business owners. In this article, we will explore how you can leverage the power of Apple Pay and MoneyCoach to effortlessly track and categorize your business-related transactions, making tax and accounting processes more manageable.

The Power of Apple Pay for Business Owners

Apple Pay is not just a convenient way to make purchases; it can also be a valuable tool for managing your business finances. This digital wallet allows you to link your credit and debit cards to your iPhone or Apple Watch, making it easy to make secure and contactless payments. What's more, Apple Pay stores detailed transaction data for each purchase you make, which can be invaluable when it comes to tracking and categorizing expenses.

Here's how you can make the most of Apple Pay for your business:

- Link Your Business Accounts: Ensure that your business credit or debit cards are linked to your Apple Pay account. This ensures that all business-related transactions are recorded within the system.

- Use Apple Pay for Business Expenses: Whenever possible, use Apple Pay to make business-related purchases. This not only ensures that the transactions are recorded but also offers the added benefit of security through Apple's encryption.

- Keep Digital Receipts: Apple Pay automatically stores digital receipts for each transaction. You can access these receipts in the Wallet app, providing a detailed record of your expenses.

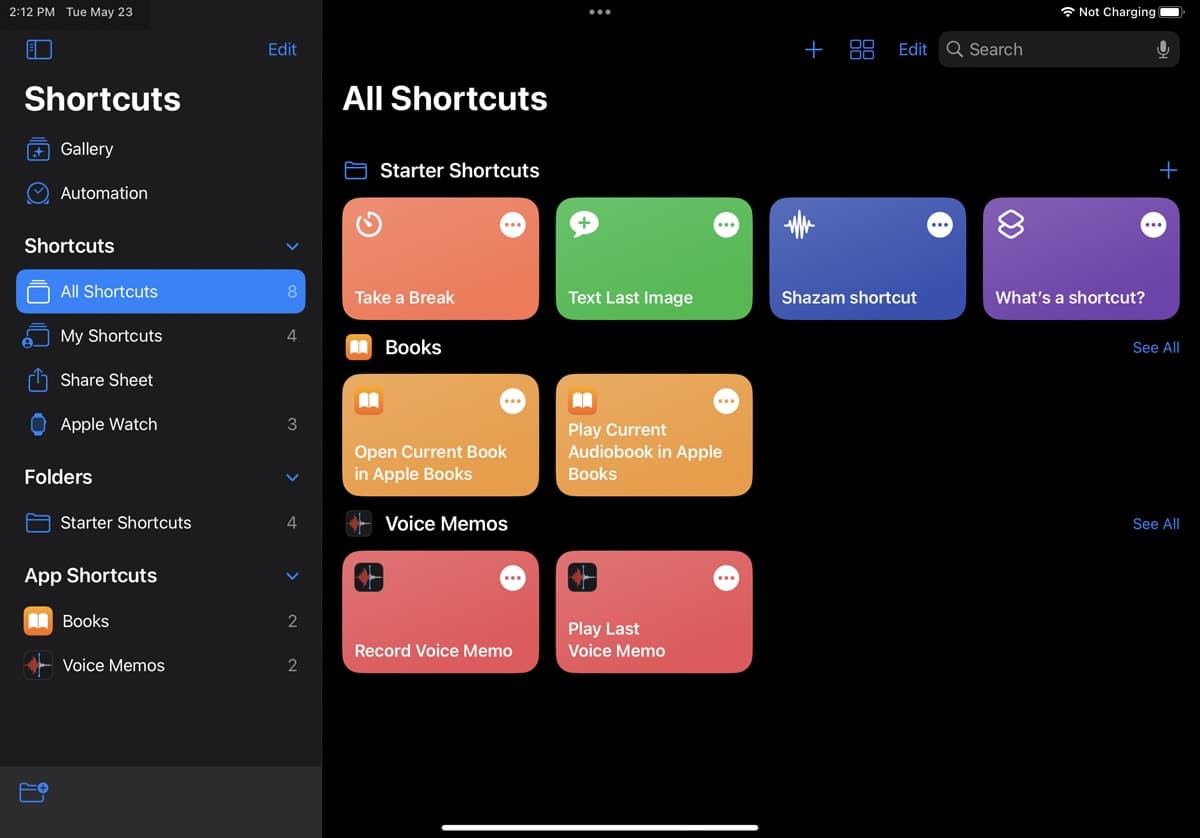

- Set Up Shortcuts Automation: To take your expense tracking to the next level, utilize Shortcuts Automation, a powerful feature on iOS devices. This allows you to automate the import and categorization of your business-related Apple Pay transactions into MoneyCoach, a financial management app that supports importing Apple Pay payments via Shortcuts Automation. Here's a guide on how to set up a shortcut automation to import payments from Apple Pay / Wallet. Just remember to select only the Business cards when you create it for the first time.

Leveraging MoneyCoach for Efficient Expense Tracking

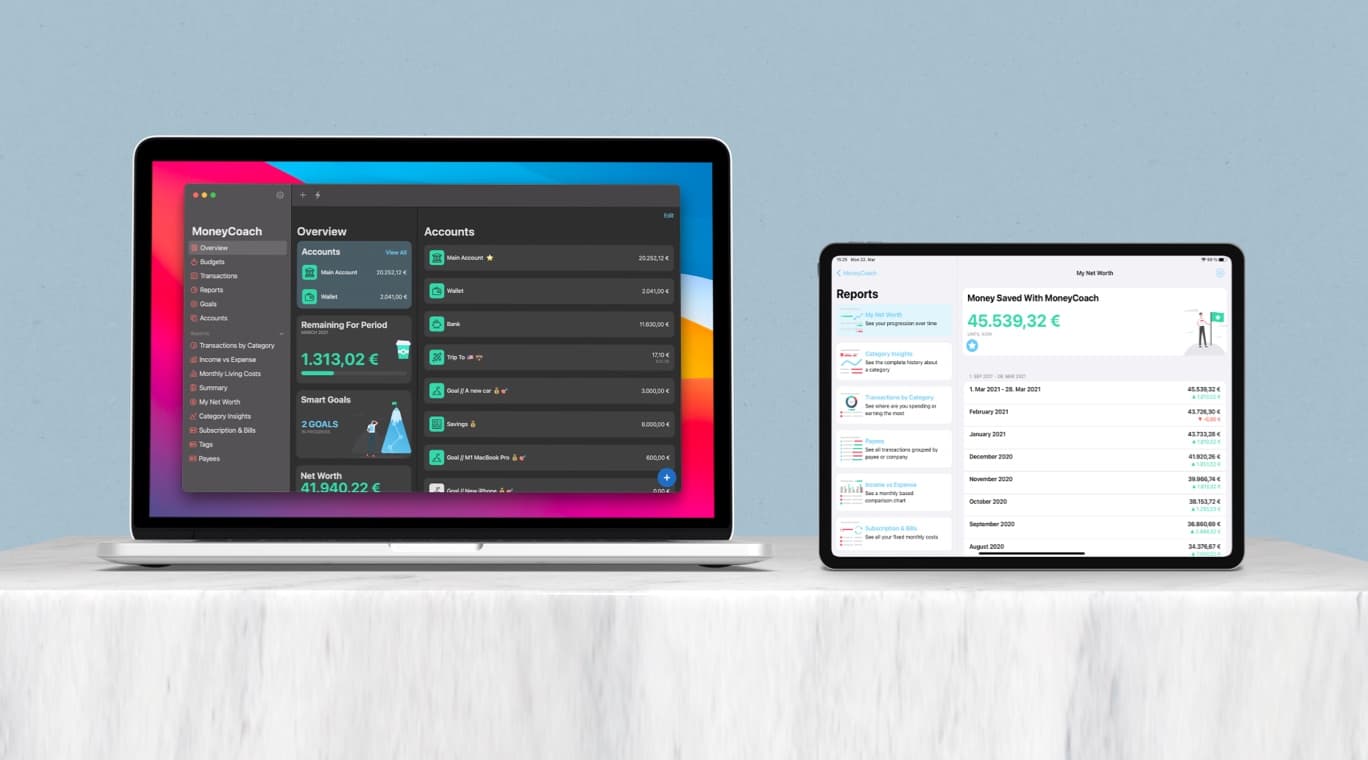

MoneyCoach is a comprehensive financial management app designed to help individuals and businesses manage their finances effectively. It offers a range of features, including the ability to import transactions from various sources, categorize expenses, generate reports, and export data for tax and accounting purposes.

Simplifying Tax and Accounting Processes

Efficient expense tracking is not only about staying organized but also about simplifying tax and accounting processes. When you use Apple Pay in conjunction with MoneyCoach, you create a streamlined workflow that can save you time and money when tax season rolls around.

Here's how this dynamic duo simplifies your financial management:

- Accurate Record-Keeping: By using Apple Pay for business expenses and importing them into MoneyCoach, you maintain a precise record of your financial transactions. This accuracy is crucial when calculating your business's income, expenses, and potential tax deductions.

- Categorized Expenses: MoneyCoach's expense categorization and ability to filter accounts allows you to classify each expense under relevant categories. This makes it easy to generate detailed expense reports that can be used for both internal analysis and tax reporting.

- Tax Deduction Identification: As you review and categorize your expenses, MoneyCoach can help you identify potential tax deductions. For example, if you have categorized a transaction as "business travel," you can easily see how much you've spent on travel-related expenses throughout the year, helping you maximize deductions and minimize your tax liability.

- Exporting Data: MoneyCoach allows you to export your financial data, including categorized business expenses, as CSV (Comma-Separated Values) files. These files can be shared with your accountant or imported into tax software, streamlining the tax preparation process.

- Business-Specific Reports: MoneyCoach provides the ability to generate reports based on your business accounts. These reports can include income statements, expense breakdowns, and more, providing valuable insights into your business's financial health.

- Peace of Mind: With Apple Pay and MoneyCoach working together, you can have peace of mind knowing that your financial records are accurate and well-organized. This not only simplifies your tax and accounting processes but also reduces the stress associated with financial management.

Tips for Effective Expense Tracking

To make the most of tracking business expenses with Apple Pay and MoneyCoach, consider implementing the following tips:

- Consistent Categorization: Develop a consistent system for categorizing expenses. This will make it easier to track spending trends and identify areas where you can cut costs.

- Review and Reconcile: Periodically review your expense records in MoneyCoach to ensure accuracy. Reconcile your digital receipts with your categorized expenses to catch any discrepancies.

- Back Up Your Data: Regularly back up your financial data, including CSV exports, to a secure location. This ensures that you have access to your records even if your device is lost or damaged.

- Consult with Professionals: If you're unsure about tax deductions or other financial matters, don't hesitate to consult with a financial advisor or accountant. They can provide guidance to help you make informed financial decisions.

Tracking business expenses is a critical aspect of running a successful business. By harnessing the power of Apple Pay and MoneyCoach, you can simplify this process, save time, and gain valuable insights into your financial health. Setting up Shortcuts Automations to import and categorize your business-related Apple Pay transactions is a game-changer that can streamline your financial management and prepare you for tax season with confidence. Remember to stay organized, review your records regularly, and seek professional advice when needed to ensure that your business finances remain on the right track. With these tools and practices in place, you'll be well-equipped to manage your business's finances effectively and make informed financial decisions.