Buying stuff can be a real rollercoaster, amiright? One minute you're scrolling through online catalogs, adding things to your cart like a boss. The next, you're staring at your credit card statement, wondering where it all went wrong.

But fear not, my friends! I'm here to share some tips that'll help you make purchasing decisions like a pro. Because let's be real, making smart buys isn't just about the money - it's about finding the perfect things that'll actually enrich your life, instead of cluttering it up.

Do Your Homework

Remember when your teachers would always harp on about the importance of research? Turns out, they were onto something. When it comes to making a good purchasing decision, doing your homework is key.

Sure, you could just impulse-buy that trendy new gadget or that cute outfit you saw on Instagram. But trust me, that's a recipe for buyer's remorse. Instead, take the time to really dig into the details.

Read reviews, compare prices, and find out everything you can about the product or service you're considering. What are the key features? How does it stack up against the competition? Is it built to last, or will it be obsolete in a few months?

The more informed you are, the better equipped you'll be to make a wise choice. Plus, the research process can actually be kind of fun. Think of it as a treasure hunt, where you get to uncover all the juicy details before you pull the trigger.

Consider Your Needs (and Wants)

Okay, so you've done your homework. Now it's time to get real with yourself about what you actually need (and want).

It's easy to get swept up in the latest trends or the flashiest features, but those things don't always align with our true needs. Before you buy anything, take a step back and ask yourself some tough questions:

- What problem is this product or service solving for me?

- Do I already have something that fills this need?

- Is this a want or a need? And is it worth the cost?

- Will this purchase enhance my life in a meaningful way?

Separating our needs from our wants can be a tricky balancing act, but it's essential for making smart purchasing decisions. Sure, that designer handbag might be a total dream, but is it really going to make your life better in a tangible way? Probably not.

On the flip side, if you've been struggling with a particular problem and this product or service is the perfect solution, then it might be well worth the investment. The key is to stay focused on what truly matters to you, rather than getting distracted by the shiny and new.

Factor in the Long-Term

Okay, so you've done your research and you've got a clear idea of your needs and wants. But before you hit that "buy" button, there's one more crucial step: considering the long-term implications of your purchase.

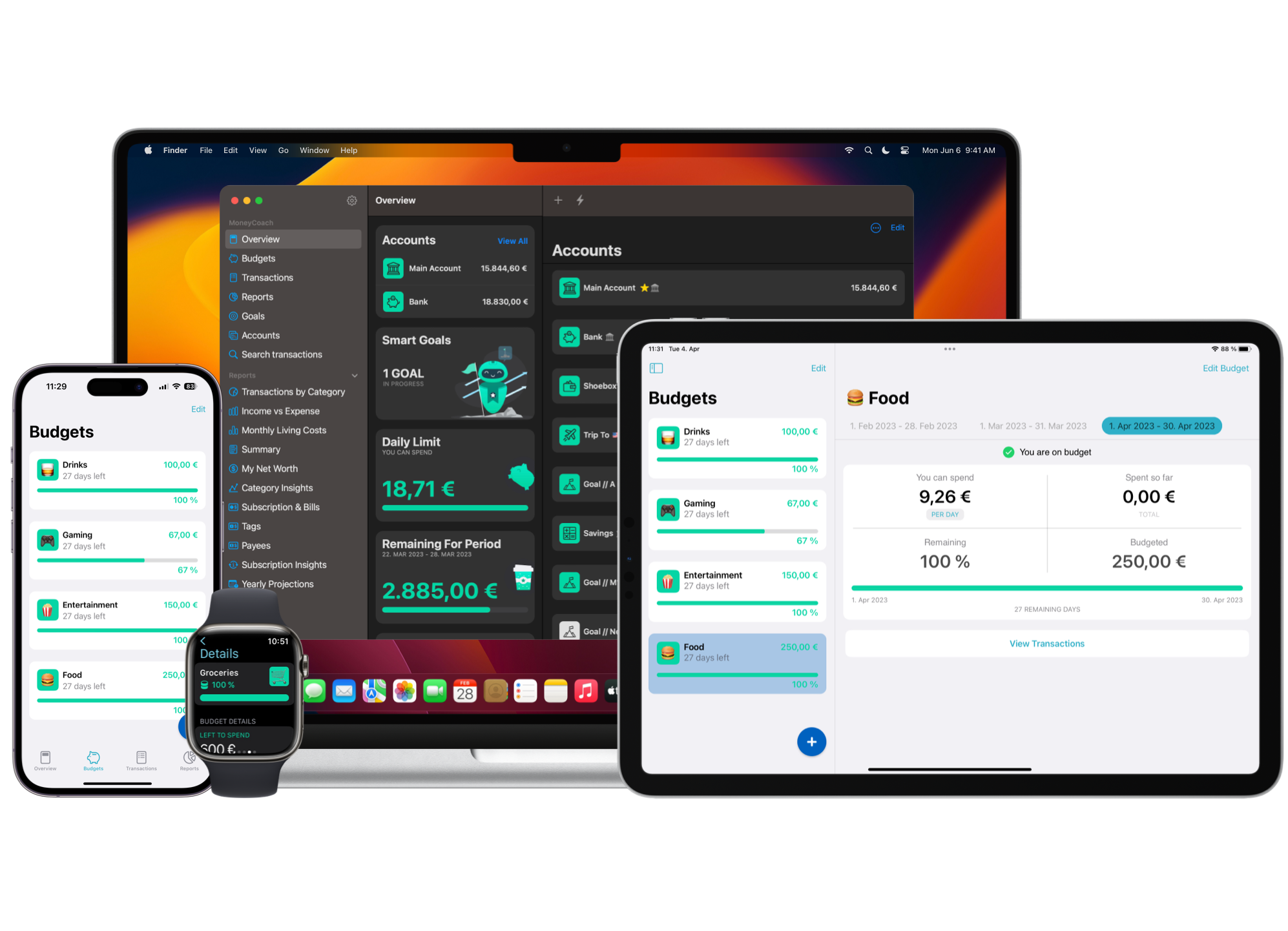

Sure, that fancy new gadget might seem like a steal in the moment. But what about the ongoing costs of maintenance, repairs, or upgrades? And how long is it realistically going to last before it becomes obsolete or needs to be replaced?

The same goes for services or subscriptions. That monthly fee might seem manageable now, but is it something you're going to stick with long-term? Will the value you get from it justify the cost over time?

By taking a broader, long-term view, you can avoid making short-sighted decisions that might end up costing you more in the long run. It's all about looking at the bigger picture and making sure your purchase aligns with your overall financial and lifestyle goals.

Trust Your Gut (But Double-Check It)

Okay, so you've done your research, you've carefully considered your needs and wants, and you've thought about the long-term implications. Now it's time to trust your gut and make a decision, right?

Well, not quite. While your instincts can be a valuable tool in the purchasing decision-making process, it's important not to rely on them exclusively. After all, our emotions and biases can sometimes cloud our judgment and lead us astray.

That's why it's a good idea to double-check your gut feeling against the evidence you've gathered. Does it align with the logical, rational decision-making process you've been following? Or is your heart just trying to override your head?

Of course, there's no one-size-fits-all formula for getting this balance right. Sometimes, your gut will be spot on, and other times, you might need to rein it in a bit. The key is to be aware of your own thought processes and to stay open to adjusting your approach as needed.

Don't Forget the Nitty-Gritty

Okay, so you've done your research, considered your needs and wants, factored in the long-term implications, and trusted your gut (with a side of double-checking). Sounds like you're ready to make a purchase, right?

Not so fast! Before you hit that "buy" button, there are a few more nitty-gritty details you'll want to take into account.

For example, have you looked into the warranty or return policy? What about shipping and delivery times? Are there any hidden fees or ongoing costs you need to be aware of?

And let's not forget about the practical stuff, like measurements and sizing. There's nothing worse than getting that perfect new outfit home only to realize it doesn't quite fit right.

By sweating the small stuff, you can avoid unpleasant surprises down the line and make sure your purchase is truly a win-win. After all, the devil is in the details, and a little extra attention can go a long way in ensuring you make a smart and satisfying buying decision.

The Art of Patience

Whew, we've covered a lot of ground here! By now, you're probably feeling like you need a Ph.D. in purchasing decisions to make a simple buy. But don't worry, my friend - the last piece of the puzzle is something you already know how to do: be patient.

Yep, that's right. In a world of instant gratification and impulse purchases, the simple act of waiting can be one of the most powerful tools in your decision-making arsenal.

Why, you ask? Well, for starters, it gives you time to really mull over all the information you've gathered and make sure you're not making a rash decision. It also allows you to see if that initial excitement or desire for a product or service is lasting, or if it's just a passing fancy.

And let's not forget the potential financial benefits of patience. By taking your time, you may be able to find better deals, discounts, or even alternatives that end up being a better fit for your needs and budget.

So, the next time you're feeling the urge to hit that "buy" button, take a deep breath and give yourself a little time. Your wallet (and your future self) will thank you.

Putting It All Together

Whew, that was a lot to unpack, wasn't it? But the truth is, making a good purchasing decision requires a whole lot more than just clicking "add to cart" on a whim.

It's about doing your homework, considering your needs and wants, factoring in the long-term, trusting your gut (with a side of double-checking), sweating the small stuff, and - last but not least - exercising a little patience.

Sure, it might seem like a lot of work, but trust me, it's worth it. By taking a more thoughtful and strategic approach to your purchases, you can avoid that sinking feeling of buyer's remorse and instead feel confident that you're making the best possible choice for your lifestyle and budget.

So, the next time you're faced with a tempting purchase, remember these tips and take the time to really think it through. Your future self will thank you – and who knows, you might even have a little fun in the process!