As millennials continue to shape the modern economy, it's essential for this generation to understand the unique financial challenges they face in the digital age. With the advent of technology, managing money has become easier and more complex at the same time. From digital payment platforms to investment apps, millennials have a wide range of tools at their disposal. However, this convenience comes with its own set of challenges. In this article, we will explore effective money management strategies for millennials, helping them navigate the financial landscape of the digital age.

Embrace Digital Tools for Budgeting and Tracking Expenses

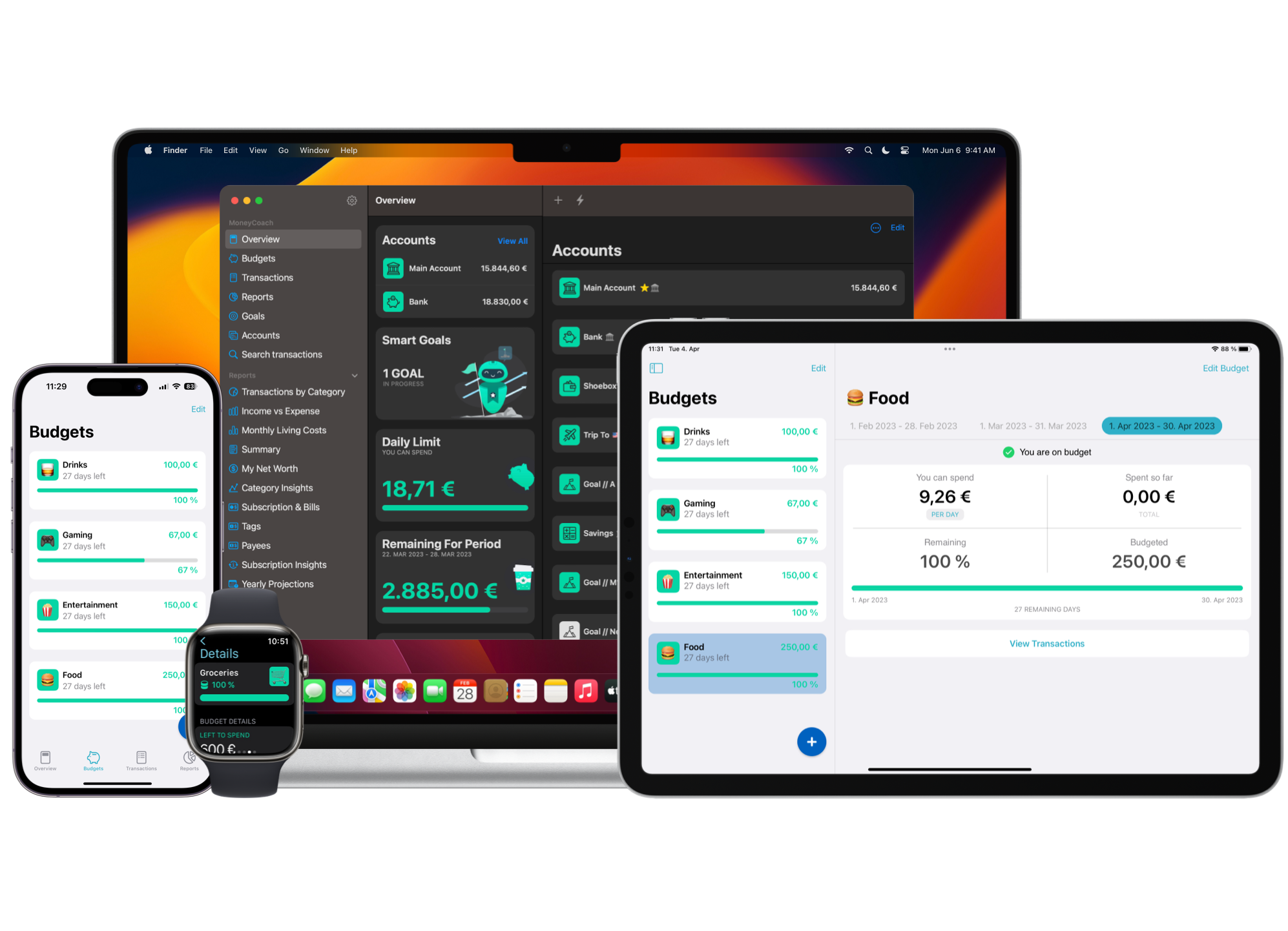

Millennials are digital natives, and harnessing the power of technology can greatly enhance their money management skills. Utilize budgeting apps and personal finance software to track your expenses, set financial goals, and monitor your progress. These tools provide a comprehensive overview of your financial health, making it easier to identify areas where you can save and optimize your spending habits.

Automate Savings and Investments

Automation is a game-changer when it comes to building wealth. Set up automatic transfers from your paycheck to a dedicated savings account. Additionally, explore investment platforms that offer features like round-up savings or recurring investments. By automating these processes, you ensure consistent progress towards your financial goals without having to rely solely on willpower.

Educate Yourself on Financial Literacy

The digital age offers a plethora of educational resources on personal finance. Take advantage of online courses, podcasts, and blogs that focus on financial literacy. Expand your knowledge on topics such as budgeting, debt management, investing, and retirement planning. Being well-informed will empower you to make better financial decisions in the digital landscape.

Be Mindful of Digital Spending Habits

The ease of online shopping and the prevalence of subscription services can lead to impulsive spending. Take a moment to evaluate your digital spending habits. Set limits on discretionary purchases and regularly review your subscriptions. Consider using browser extensions or mobile apps that help you track and manage your online spending, providing you with insights into where your money is going.

Protect Your Financial Information

As technology advances, so do the risks associated with it. Protect yourself from financial fraud and identity theft by implementing robust security measures. Use strong, unique passwords for your online accounts, enable two-factor authentication, and be cautious when sharing sensitive information online. Regularly monitor your financial accounts for any suspicious activity.

Leverage Technology for Investment Opportunities

The digital age has democratized investing, offering millennials access to a wide range of investment opportunities. Research and explore platforms that allow you to invest in stocks, exchange-traded funds (ETFs), or even cryptocurrencies. However, exercise caution and conduct thorough research before making any investment decisions. Understand the risks involved and diversify your portfolio to minimize potential losses.

Seek Professional Advice

While technology provides a wealth of information, there's no substitute for personalized financial advice from professionals. Consider consulting a financial advisor who specializes in working with millennials. They can provide guidance tailored to your specific financial goals and help you navigate complex financial situations.

Money management in the digital age requires millennials to adapt and embrace the tools and resources available. By leveraging digital platforms for budgeting, automating savings, educating themselves, and protecting their financial information, millennials can overcome the challenges and make informed financial decisions. With careful planning and a proactive approach, millennials can navigate the digital landscape and build a strong foundation for a secure financial future.

MoneyCoach can be a useful tool for millenials who want to take control of their finances and achieve their financial goals. By providing a range of features to help millenials track their spending, set budgets, and monitor their progress, MoneyCoach can help millenials make the most of their money and avoid financial stress.