As a recent graduate, managing your student loans can be a daunting task. One of the most important steps in paying off your loans is creating a budget. A budget helps you manage your money and prioritize your loan payments.

Here's why you should plan to pay back more than the minimum when creating a budget to repay your student loans:

1. Reduce interest

The longer it takes you to pay off your loans, the more interest you'll pay. Paying more than the minimum can help you reduce the amount of interest you owe over time.

2. Pay off loans faster

Paying more than the minimum can help you pay off your loans faster, allowing you to become debt-free sooner.

3. Improve credit score

Making larger payments can help you improve your credit score by reducing your debt-to-income ratio.

4. Save money in the long run

By paying more than the minimum, you can save money in the long run by reducing the overall amount you owe.

When creating a budget to repay your student loans, it's important to prioritize your loan payments. This means allocating a significant portion of your income towards your loans. If you can afford to pay more than the minimum, it's a good idea to do so.

Here are some tips for creating a budget to repay your student loans:

Determine your income

Calculate how much money you have coming in each month.

Calculate your expenses

Determine how much you're spending on bills, rent, food, and other necessities.

Set a loan payment goal

Determine how much you want to pay each month towards your loans.

Reduce expenses

Look for ways to reduce your expenses, such as cutting back on eating out or finding cheaper rent.

Stick to your budget

Once you've created a budget, stick to it. This will help you pay off your loans faster and avoid accumulating additional debt.

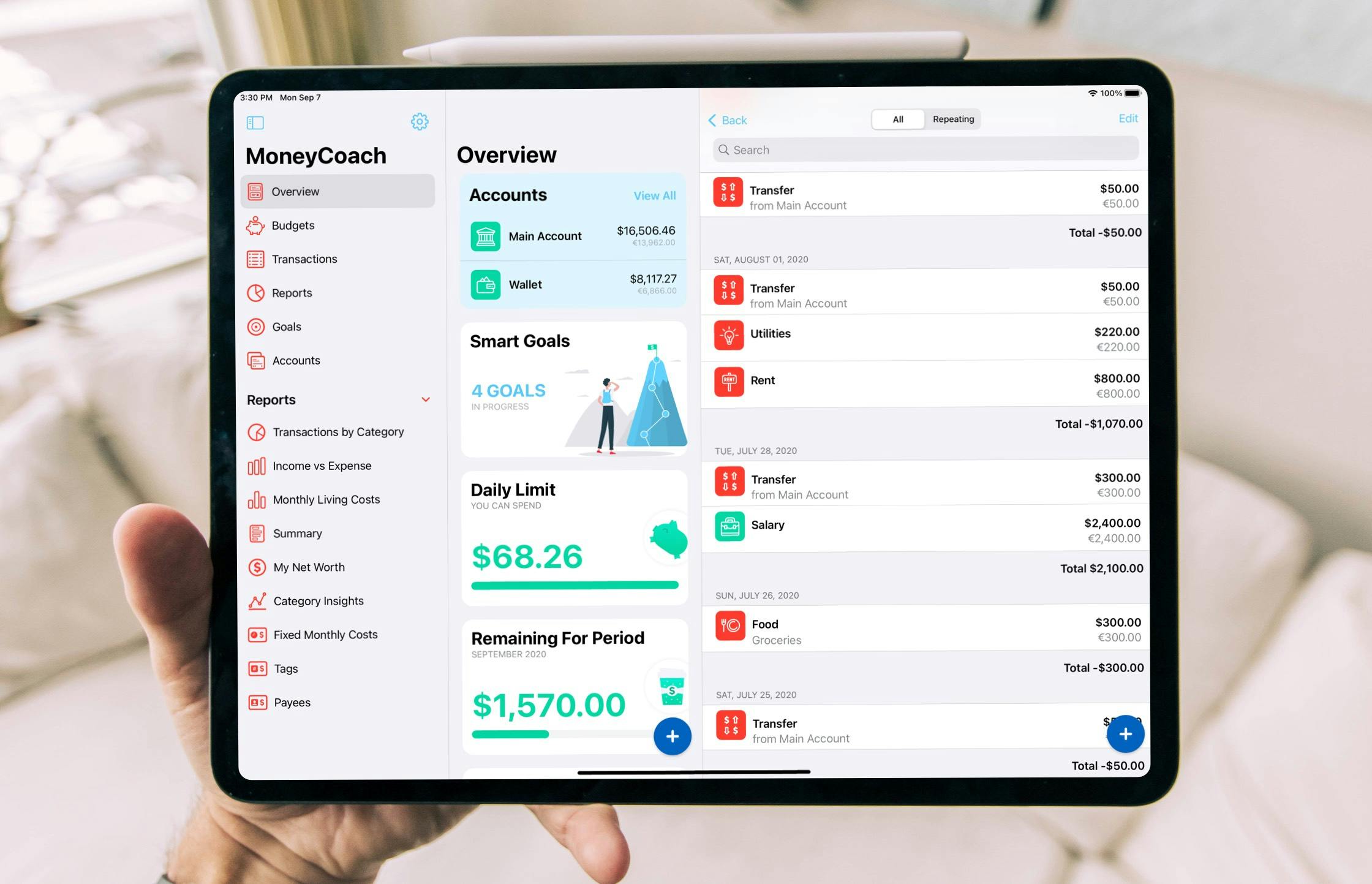

We specifically designed MoneyCoach to help managing your student loans. Find out how the app can help you start your financial freedom journey today!