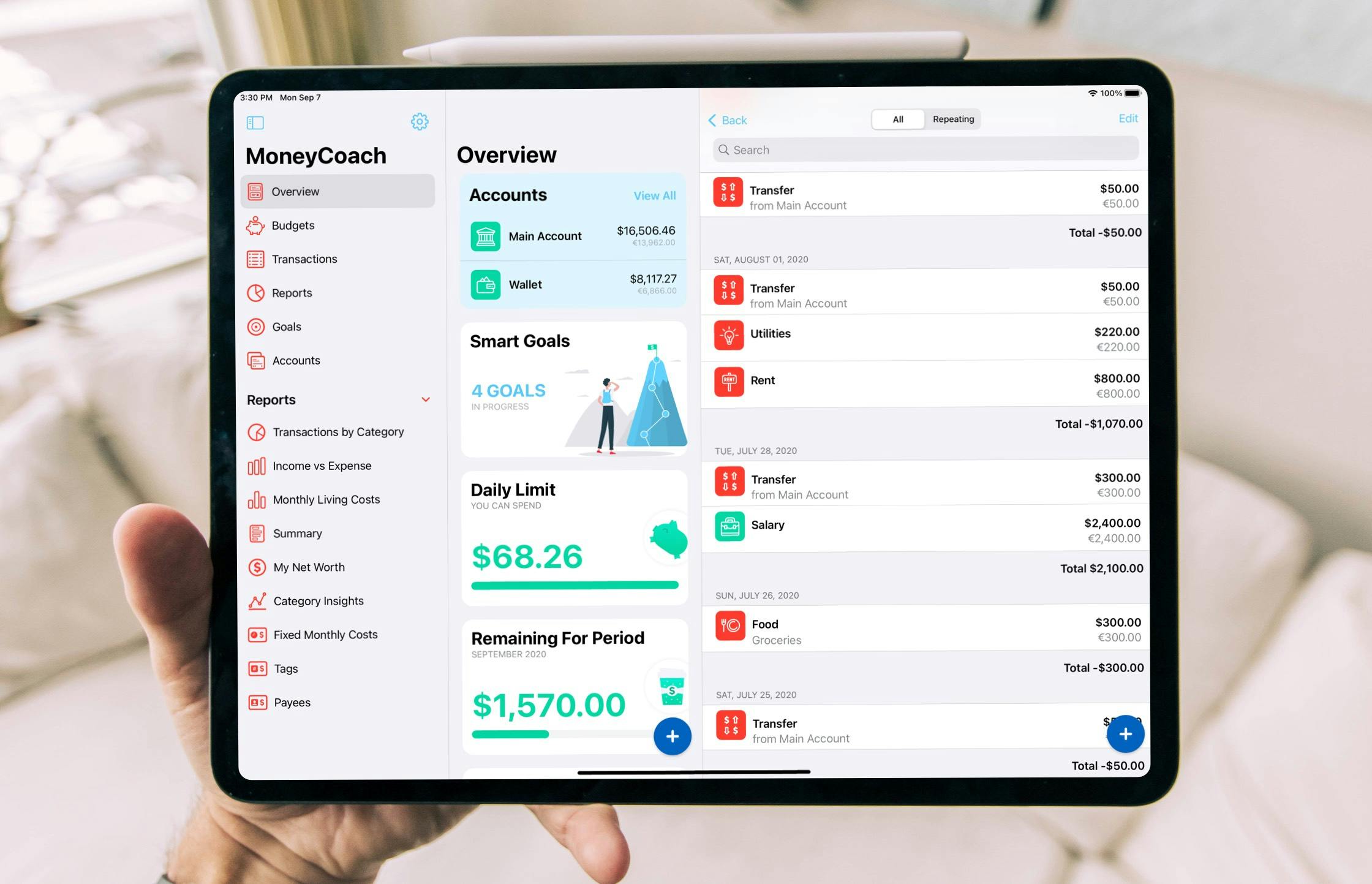

Managing finances can be challenging for anyone, but for students on a tight budget, it can be especially tough. Fortunately, there are tools available to help students track their spending, set budgets, and achieve their financial goals. One such tool is MoneyCoach, an iOS app designed to help students plan their budgets and manage their finances.

MoneyCoach offers a range of features to help students stay on top of their finances, including:

Budget tracking

With MoneyCoach, students can easily track their spending and monitor their budget. The app provides an overview of expenses in different categories, so students can see where their money is going and identify areas where they need to cut back.

Goal setting

MoneyCoach allows students to set financial goals, such as saving for a trip or paying off debt, and track their progress towards these goals. This feature helps students stay motivated and focused on achieving their financial objectives.

Bill tracking

The app also allows students to keep track of their bills, such as rent, utilities, and other monthly expenses. This feature helps students avoid late fees and stay on top of their bills.

Customizable categories

MoneyCoach allows students to customize their spending categories, so they can track expenses in a way that makes sense for them. This feature helps students stay organized and ensure that they're accounting for all of their expenses.

MoneyCoach can be a useful tool for students who want to take control of their finances and achieve their financial goals. By providing a range of features to help students track their spending, set budgets, and monitor their progress, MoneyCoach can help students make the most of their money and avoid financial stress.