Credit: immediate.net

Credit: immediate.netBuilding long-term wealth is a goal shared by many individuals. While there is no magical formula for instant riches, strategic and informed investment decisions can pave the way towards financial prosperity. However, navigating the complex world of investing can be daunting, particularly for beginners. In this article, we will unlock the secrets of long-term wealth by outlining investment strategies tailored to newcomers to help them embark on their journey to financial success.

Set Clear Financial Goals

Before diving into the world of investments, it's crucial to establish clear financial goals. Are you saving for retirement, a down payment on a house, or a child's education? Defining your objectives will help shape your investment strategy and determine the level of risk you're willing to undertake.

Educate Yourself

Investing is a dynamic field, and staying well-informed is key to making sound investment decisions. Take the time to educate yourself on investment basics, including different asset classes, risk management, and portfolio diversification. Online resources, books, and financial courses can provide valuable knowledge to lay a solid foundation.

Start with a Solid Financial Foundation

Before entering the world of investing, it's important to have a solid financial foundation. Pay off high-interest debts, establish an emergency fund, and ensure you have adequate insurance coverage. By strengthening your financial base, you'll be better prepared to weather any unexpected financial challenges.

Embrace the Power of Compounding

Compound interest is a powerful tool for long-term wealth creation. By reinvesting your earnings and allowing them to grow over time, your investments can experience exponential growth. Starting early and consistently contributing to your investment portfolio will maximize the benefits of compounding.

Diversify Your Portfolio

Diversification is a fundamental strategy to mitigate risk. Rather than putting all your eggs in one basket, spread your investments across different asset classes such as stocks, bonds, real estate, and mutual funds. Diversification helps protect your portfolio from significant losses and allows you to capture potential gains from different sectors of the economy.

Determine Your Risk Tolerance

Understanding your risk tolerance is crucial for crafting an investment strategy that aligns with your comfort level. Some investments, such as stocks, carry higher risks but offer the potential for higher returns. Others, like bonds, tend to be more conservative and provide stability. Assess your risk tolerance carefully and strike a balance between risk and potential rewards.

Invest for the Long Term

Successful investors recognize that investing is a marathon, not a sprint. Short-term market fluctuations are inevitable, but focusing on the long term allows you to ride out market volatility and benefit from the overall growth of the economy. Develop a patient mindset and avoid making impulsive decisions based on short-term market movements.

Seek Professional Guidance

If you feel overwhelmed or lack confidence in your investment decisions, consider seeking professional guidance. Financial advisors can provide personalized advice based on your financial goals, risk tolerance, and investment horizon. They can help you design a comprehensive investment plan and provide ongoing support and monitoring.

Monitor and Rebalance Your Portfolio

Investing is an ongoing process that requires regular monitoring and periodic rebalancing. Keep track of your investments, review your portfolio's performance, and make adjustments as needed. Rebalancing involves selling investments that have become overweighted and reinvesting in underrepresented assets, maintaining your desired asset allocation.

Investing in the pursuit of long-term wealth is a journey that requires patience, knowledge, and a well-defined strategy. By setting clear goals, educating yourself, diversifying your portfolio, and investing for the long term, you can unlock the secrets of long-term wealth. Remember to adapt your strategy as your circumstances change and to seek professional

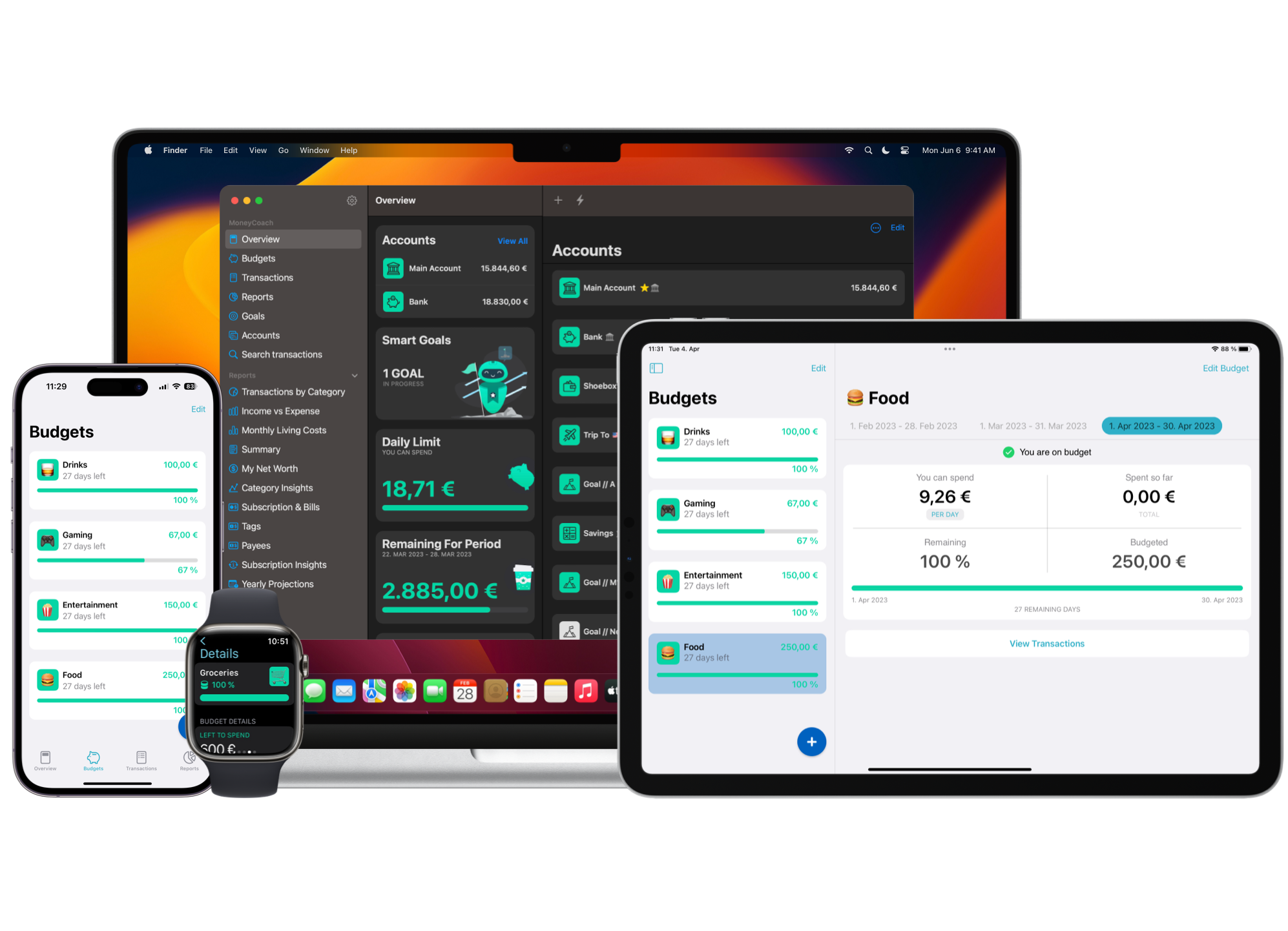

MoneyCoach can be a useful tool and help you keep track of all your investments.