One of many acquired skills is learning how to manage money. Most people at one point in time have had to make difficult decisions on organizing their finances – choosing between what they want and what they need. However, it may have seemed impossible due to certain factors, thus affecting financial health and general well-being.

In this chaos comes a solution – a budgeting app to help organize finances, understand income, and gain absolute control over spending habits.

What Is a Budget Application?

A budgeting app is software designed for mobile devices (smartphones and PCs) to help people create a budget and track their finances (savings, expenses, and income). This digital platform allows individuals to optimize spending, helping them focus on what is important and what can be suspended for later.

Benefits of Budgeting Apps

Budgeting platforms can prove useful in many ways, some of which include:

-

Goal Planning A budget app allows you to plan your goals and overcome whatever obstacle there is regarding money – for instance, debts. You can easily sort out emergencies and pay off your loans (e.g., mortgage, car, or education) if you organize your finances and decide on a strategy that would work based on your monthly or annual income.

-

Improved Financial Habits The digital software also helps in encouraging discipline and improving financial habits. Some apps have been equipped with built-in features like alerts and budget limits to notify users of risks and how to overcome them immediately with zero or minimal adverse financial impact. They also provide valuable insights into spending habits with other unique features, like investment tracking.

-

Reduced Stress Financial burden is tough work, and most people get overwhelmed. However, these digital platforms will take that load off, allowing you to focus on more important things that would improve your well-being. Indeed, it is convenient.

How Do You Choose a Budgeting App?

The importance of a budget digital platform must be considered. Unfortunately, while these apps aim to make your life better, some scam platforms exist due to the unlimited options available. Hence, if you have to choose a budgeting app, you need to consider specific factors, just as shown below:

Built-in Features

Every mobile application has what is unique to it – it is usually designed to ensure a good user experience. Hence, the first step is to find out what the built-in features are and the level of convenience. You may find common features like adding all financial accounts, credit score checks, goal tracking/monitoring and notification settings, and even a communication channel to speak with a financial advisor.

Subscription Fees

Another factor to look out for is the subscription fees – these apps may or may not be free. However, there is a good guarantee that subscription-based digital tools offer a wide range of tools that will effectively help your finances compared to the free options. Thus, it would help if you went for them but chose an option that suits your budget.

Security Protocol

Financial apps can be vulnerable, especially to hacks or cyberattacks. Hence, you should make sure that the digital platform offers a good security protocol for your financial data, such as multi-factor authentication or 256-bit encryption technology.

Device Compatibility

Before you download and install budgeting software on your device, you should ensure it is compatible with it. Some apps are selective, and you need to find this information to get the best experience.

Customer Support Quality

Good customer support reflects the quality of the digital platform. If the app offers several means of communication (email, video chat, chatbot)and excellent response times to resolve whatever issues may occur, it is a good one and can be used to manage finances.

Additional Advanced Features

Apart from the common considerations, choose a budgeting app based on its advanced features. Depending on your financial goals/plans, you may select an option that suits perfectly with your needs. For instance, some digital apps offer advanced features, such as debt management, subscription tracking, financial forecasting, family budgeting, investment tracking, and customizable reports to users. Hence, you need to review your options and choose whatever guarantees the best experience.

MoneyCoach.AI: The Perfect Money-Budgeting App You Need

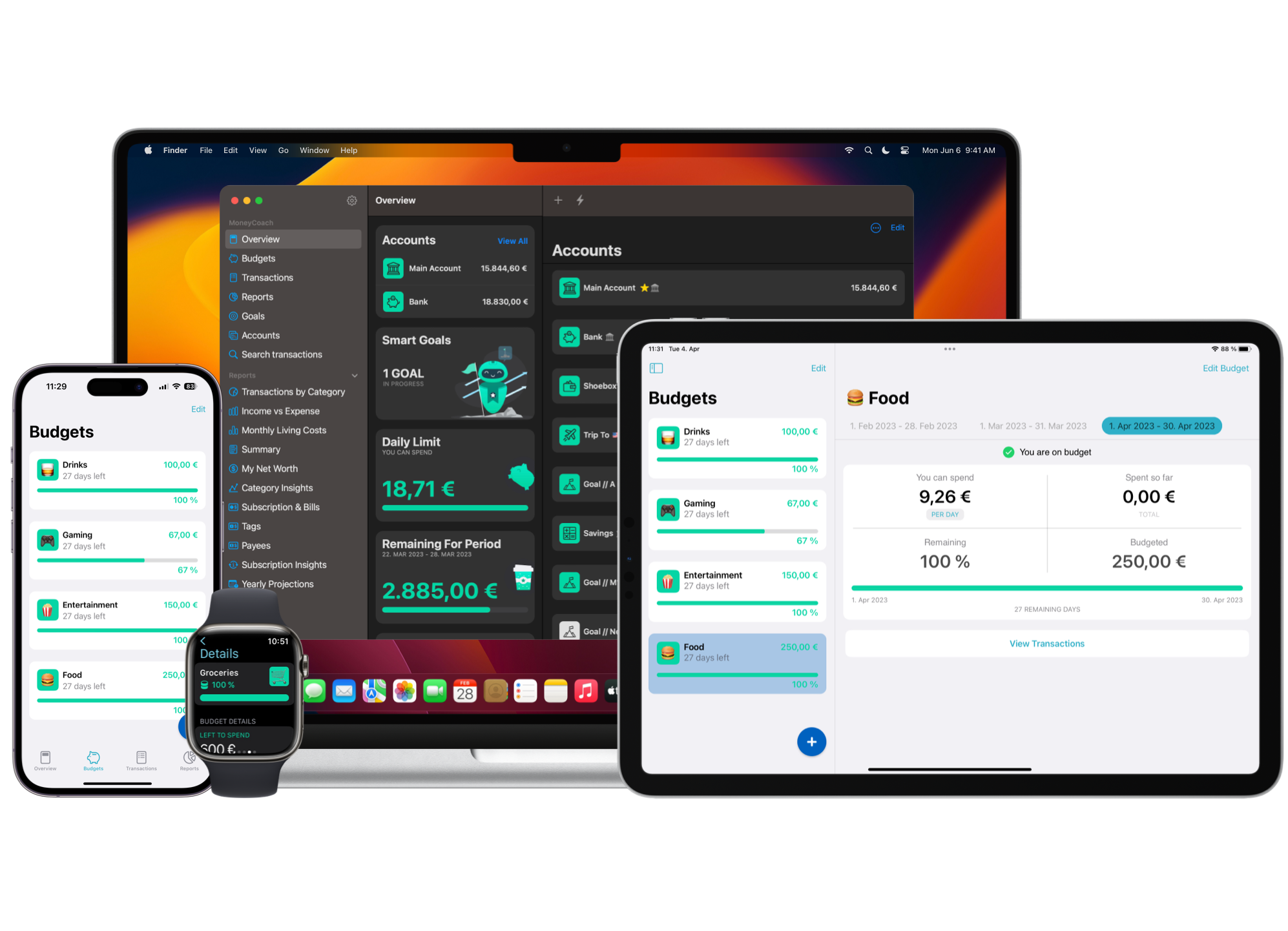

MoneyCoach.AI is one of the best personal budgeting apps that helps people track cash spending and reduces their financial burden. This modern money manager allows you to track all accounts (savings, offline banks, and credit cards) in one platform, granting total control, even over cash. It also provides net worth in real-time.

The software offers two unique experiences:

-

Shared It allows users to share financial data with other people, like family, relatives, or friends. This fosters a collaborative account and ensures accountability of spending habits.

-

Personal Overview The personal view offers a personalized approach, with the ability to customize sharing options with other people. It also helps track spending habits.

MoneyCoach.AI comes with additional features for a unique experience, such as Family Sync (for family sharing via private iCloud), Smart Budgets (to limit spending and save more money), and Smart Goals (to set custom goals and achieve them).

This budgeting app is compatible with Apple iOS – it can be connected to Apple Watch and macOS, and it provides an immersive experience with visionOS.

How to Use MoneyCoach.ai?

- Visit the moneycoach.ai site

- Click on Download and Install app on your Apple device

- Create an Account

- Set up a budget

- Start tracking your finances.

Additional Strategies to Improve Finances

To further organize finances, here are some useful tips:

- Understand your finances and distinguish between Needs and Wants.

- Develop a feasible savings plan based on your income flow – for example, a 50/30/20 budget – 50% essentials, 30% spending, and 20% saving.

- Utilize budget app alternatives, like zero-based budgeting and envelope systems.

- Review your financial plan constantly and adjust based on goals.

- Reach out to a financial advisor.

Upbeat recommends MoneyCoach.AI as one of the best money-budgeting applications for organizing finances. It comes with a unique approach that optimizes financial health, builds wealth, and allows users to gain control over their spending. You can start using this software to track your money on a personalized or shared basis by simply downloading and installing the application on App Store.