Managing finances comes pretty naturally to some young adults. They know exactly how much they’ve spent and how much they can spend while maintaining a sizable budget at the same time.

For others, managing their spending can prove to be virtually impossible for various reasons. But living from paycheck to paycheck is not the answer, which is why we’ve prepared some important tips about finance that young adults can use to track and manage their spending and avoid constantly worrying about money.

For others, managing their spending can prove to be virtually impossible for various reasons. But living from paycheck to paycheck is not the answer, which is why we’ve prepared some important tips about finance that young adults can use to track and manage their spending and avoid constantly worrying about money.

1. Make sure you’re paid what you are worth (aka first rule of finance managing)

Do a thorough assessment of your current skill set, in-office productivity levels regarding various job-related tasks, as well as your contribution to the company you’re working for. Research the going rates for your particular job, both inside and outside the company in order to check whether you’re getting paid your worth. Getting underpaid even a couple of hundreds of bucks a year might not be that much of an issue now, but consider how much money you’ll be losing during the course of a year or two.

2.Set a budget and stick to it

Setting clear goals in regard to spending and saving your money is the first step towards creating a proper budgeting plan. The goal isn’t to count every single penny you spend, but rather to control your spending by spending less than what you make and focusing your spending on things that really matter. There are numerous ways in which you can control your finance, but your main preoccupation should be meeting this goal.

3. Track your spending for a while

Although tracking your finances is not a goal when it comes to budgeting, keeping track of your spending over a short time period could give you a much-needed insight into how you manage and spend your money. Most people who’ve experienced difficulties in managing their finances should try this, as it can be quite an eye-opening experience and it could potentially reveal some spending areas that normally go unnoticed.

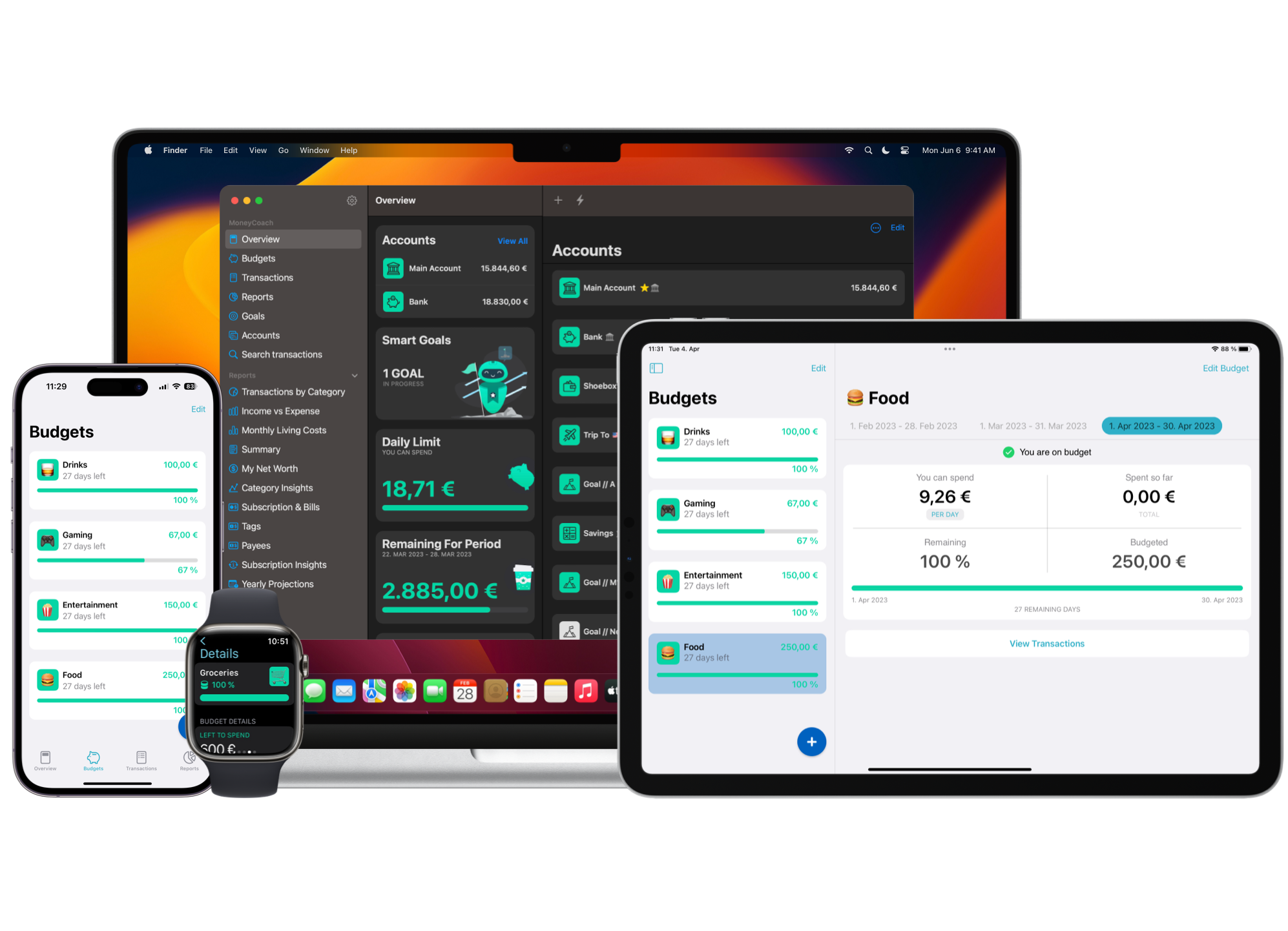

Ideally, you should track your finances for at least a month. However, tracking for even a week could end up providing you with valuable information regarding your spending habits. And our MoneyCoach app offers just an unparalleled and easy way to track all your spending habits. Try it for free now

Ideally, you should track your finances for at least a month. However, tracking for even a week could end up providing you with valuable information regarding your spending habits. And our MoneyCoach app offers just an unparalleled and easy way to track all your spending habits. Try it for free now

4. Pay off any credit card debts you may have

You’d be surprised by the number of people struggling with their credit card debts. The issue is that people use them for anything, whether it’s a small purchase in their local grocery store or something large like shopping for furniture. Granted, credit cards are extremely easy to use, so people often forget that they’re dealing with real money when using them.

5. Manage other types of debt

Accruing debt is easier than you might think. Without a proper strategic management plan, debt can quickly pile up and put you even further behind. Managing your debt includes tactically paying off the largest debts you have first, such as credit cards debts. These should be followed by managing personal loans, student loans and finally, any housing debt you might have.

Besides regulating existing debts, debt management also includes avoiding making any future debts, as well as looking for ways to cut down on spending, and generally trying to spend smarter. For example, instead of buying expensive breakfast or a cup of coffee, you might want to consider packing your lunch or investing in a coffee machine and brewing it yourself, which will allow you to save a lot of money in the long run.

6. Review your insurance

Regularly reviewing your insurance allows you to change the coverage amounts in case your needs change over time, no matter whether it’s health and life insurance, disability insurance, homeowner’s insurance or car insurance. Alternatively, you might decide that you need additional insurance, such as a dedicated umbrella policy to cover any liabilities you might have. Although insurance is not the most interesting topic out there, it is a form of financial planning that is crucial for living a life of financial security.

##7. Consider talking to a professional

If you’re one of those people who simply can’t manage their spending, then you might want to consider hiring a professional credit or debt counselor. However, for their work to be successful, they need to know everything about your income, debts, and expenses. If you wish to be provided with financial help over a longer period of time, you should consider hiring a personal advisor or a financial planner.

They offer valuable finance advice and budgeting services for a small fee. However, don’t call them once you’re in over your head; instead, contact them early on while they still have the chance to actually help you and steer you away from a personal bankruptcy.

These are just some of the tips that can help you manage your finances. The important thing is that you recognize your financial difficulties in time and tackle them head on before they spiral out of control. Track your finances for a while just to paint a picture of what your spending looks like. You’d be surprised at just how much money we waste on small things here and there and how quickly these small expenses snowball into accruing debt we will later struggle to pay off.