Managing your finances can be challenging, especially if you have multiple expenses to take care of. However, budgeting is a powerful tool that can help you save money, pay off debt, and achieve your financial goals. We'll discuss ten budgeting strategies that can help you save more money and achieve your financial goals.

Create a Budget

Creating a budget is the first step in managing your finances. Start by tracking your income and expenses for a month. Categorize your expenses and identify areas where you can cut back. Use this information to create a budget that fits your income and helps you save money.

Set Financial Goals

Setting financial goals can help you stay motivated and focused. Determine what you want to achieve financially, whether it's paying off debt, saving for a down payment on a house, or starting a business. Make sure your goals are specific, measurable, and achievable.

Prioritize Your Spending

Prioritize your spending by focusing on your essential expenses first. This includes housing, utilities, transportation, and food. Once you've taken care of these expenses, allocate money towards your financial goals and entertainment.

Use Cash Instead of Credit

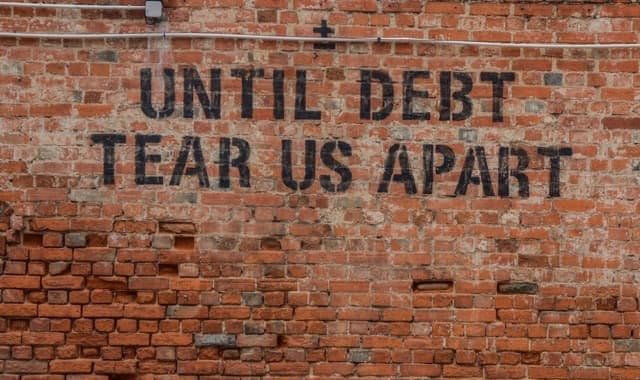

Using cash instead of credit can help you save money and stay within your budget. Withdraw a set amount of cash each week or month and use it to pay for your expenses. This will help you avoid overspending and accumulating debt.

Use Budgeting Apps

Budgeting apps like MoneyCoach, YNAB, and PocketGuard can help you track your expenses, manage your budget, and achieve your financial goals. These apps are easy to use and can provide valuable insights into your spending habits.

Negotiate Bills

Negotiating bills like cable, internet, and phone can help you save money each month. Contact your service provider and ask for a discount or a better rate. You can also shop around for better deals and switch providers if necessary.

Plan Your Meals

Planning your meals can help you save money on food and avoid eating out. Make a weekly meal plan, and create a shopping list based on the ingredients you need. This will help you avoid impulse purchases and save money on groceries.

Use Coupons and Cashback Programs

Using coupons and cashback programs can help you save money on your purchases. Look for coupons in newspapers, magazines, and online. Use cashback programs like Rakuten, Swagbucks, and Ibotta to earn money back on your purchases.

Automate Your Savings

Automating your savings can help you save money without thinking about it. Set up automatic transfers from your checking account to your savings account each month. This will help you build your emergency fund and save for your financial goals.

Review Your Budget Regularly

Review your budget regularly to ensure it's still working for you. Track your expenses, and adjust your budget if necessary. Make sure you're staying on track with your financial goals and adjust your budget accordingly.

In conclusion, budgeting can help you save money, pay off debt, and achieve your financial goals. Use these ten budgeting strategies to take control of your finances and build a better financial future.