Let's be honest: budgeting can be tough. It's not always easy to stick to your financial plan, and there are a lot of common mistakes that people make along the way. But don't worry! With a few tips and tricks, you can avoid these common mistakes and stay on track towards achieving your financial goals.

1. Not tracking your expenses

One of the most important parts of budgeting is tracking your expenses. If you don't keep track of what you're spending your money on, it's easy to overspend and lose track of your financial goals. Luckily, there are plenty of tools available to help you keep track of your expenses. You can use a spreadsheet, a budgeting app, or even just a notebook to record your expenses.

2. Setting unrealistic goals

Another common mistake people make when budgeting is setting unrealistic goals. It's great to have big financial goals, but if they're not achievable, you're setting yourself up for failure. Start with smaller, achievable goals and work your way up. This will help you stay motivated and on track towards achieving your larger financial goals.

1. Not accounting for unexpected expenses

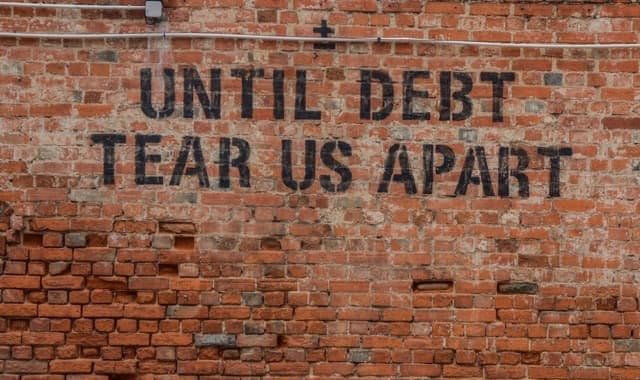

Life is unpredictable, and unexpected expenses can pop up at any time. It's important to include a buffer in your budget for these unexpected expenses. This will help you avoid dipping into your emergency fund or going into debt when something unexpected comes up.

1. Neglecting to adjust your budget

Your budget isn't set in stone. It's important to regularly review and adjust your budget as your financial situation changes. If you get a raise, for example, you might want to adjust your budget to include more savings or investments.

1. Not rewarding yourself

Budgeting can be hard work, and it's important to reward yourself for sticking to your financial plan. This doesn't mean going on a shopping spree, but rather treating yourself to something small, like a nice dinner or a movie night.

By avoiding these common mistakes, you'll be well on your way to achieving your financial goals. Remember to track your expenses, set achievable goals, account for unexpected expenses, adjust your budget as needed, and reward yourself for your hard work. With a little bit of discipline and dedication, you can take control of your finances and achieve financial freedom.