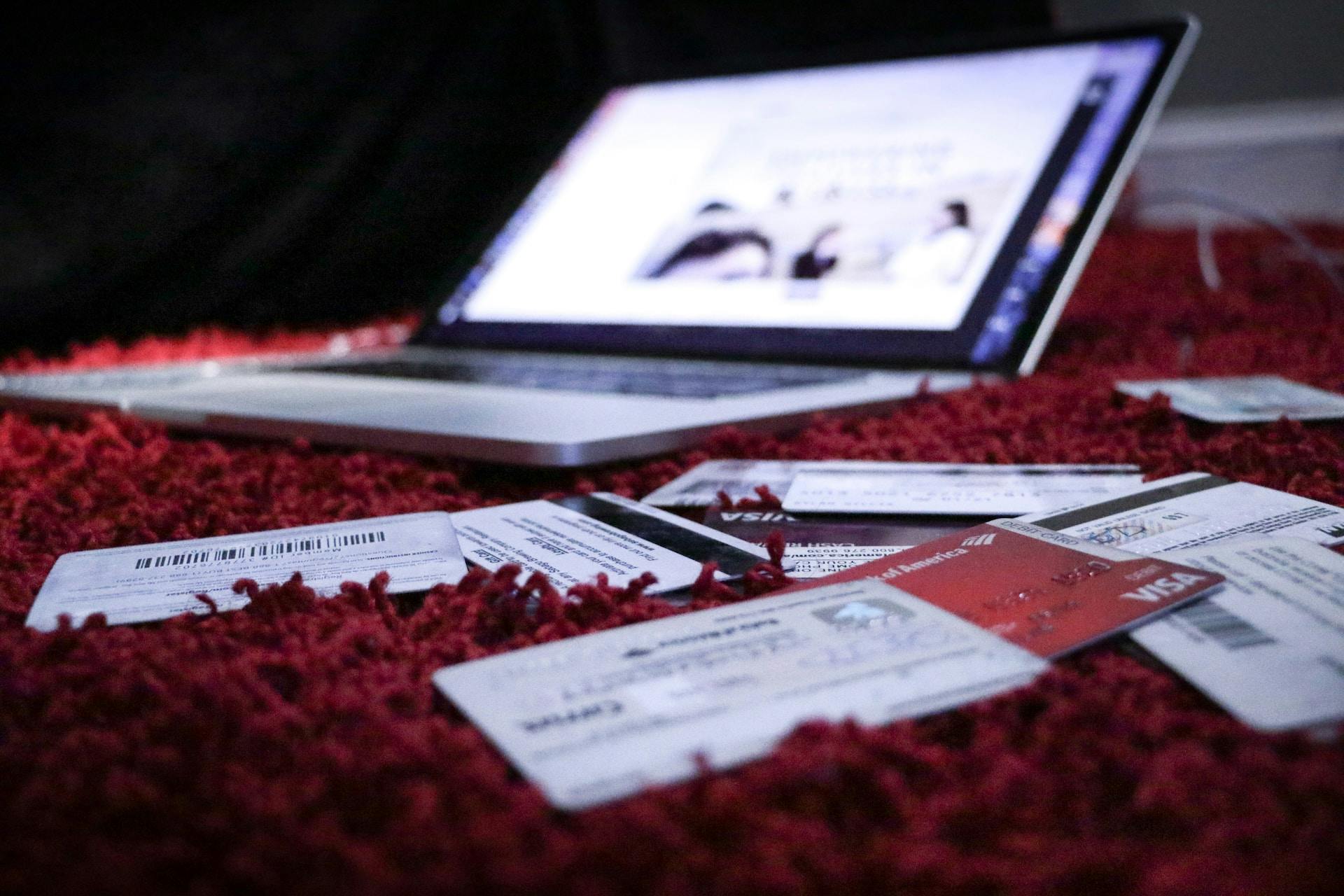

Credit card churning is a practice that involves applying for and canceling multiple credit cards to take advantage of sign-up bonuses and rewards. While it can be a lucrative strategy for earning rewards, it also comes with risks and potential downsides. In this article, we'll discuss the ins and outs of credit card churning, including how it works, the benefits, and the cons.

What Is Credit Card Churning?

Credit card churning is the practice of opening and closing multiple credit card accounts in a short period to earn sign-up bonuses and rewards. The strategy involves meeting the minimum spending requirements to receive the sign-up bonus and then closing the account before the annual fee kicks in. The goal is to maximize rewards and minimize costs.

How It Works

To practice credit card churning, you'll need to follow these steps:

- Apply for a credit card with a sign-up bonus.

- Meet the minimum spending requirement to earn the bonus.

- Redeem the bonus rewards.

- Close the account before the annual fee kicks in.

- Repeat the process with a new credit card.

- Benefits of Credit Card Churning

The primary benefit of credit card churning is the ability to earn sign-up bonuses and rewards, which can be redeemed for travel, cash back, or other perks. By opening and closing multiple credit card accounts, you can accumulate a large number of rewards without paying annual fees or interest charges.

Potential Risks and Downsides

Credit card churning comes with risks and downsides, including:

1. Damage to credit score

Frequent credit card applications can lower your credit score, making it harder to qualify for loans or credit in the future.

2. Annual fees

Some credit cards come with high annual fees, which can offset the rewards earned from sign-up bonuses.

3. Interest charges

If you carry a balance on your credit card, you'll be subject to high-interest charges, which can negate the benefits of credit card churning.

4. Blacklisting

Some credit card issuers may blacklist users who engage in credit card churning, making it harder to qualify for future credit cards or rewards.

MoneyCoach now supports manual credit card tracking. Set up your credit cards and activate the payment due reminders to avoid paying credit card interests.