Today is a great time to update your current routine and adopt new behaviors that fit into your lifestyle. "Why, what day is today?" you might be asking and the answer is simple. It doesn't matter what today actually is.

Today is the day you decide to change your life for the better. Today is a great time to tackle your finances so here are 4 simple things you can do to improve your finances.

(Re)Start Budgeting

It happens to the best of us. We set up a budget, we try to follow it, but shortly after we fall from actually sticking to it. We spend more money on things that might not really matter that much to us in the first place because we are always looking for that sweet gratification shopping offers us.

This is bad for our finances. We might need money for an emergency or for something we truly need and we might not have it cause well, we've spent it.

Or it may be that we didn't really have a budget up to this point and we were just spending money all willy-nilly. This, in fact, is even worse for our finances.

So, today, I want you to start or restart a budget. Gather all of your monthly bills and examine both your income and your expenses. Then subtract your expenses from how much money you make and if that number is less than zero, you are spending more money than you make. You need to change that as soon as possible and carefully create a budget where you save some money at the end of the month.

Understand Your Spending

I want you to take a closer look at how you are spending your money. Did you really need that second new MagSafe Charger? How about that 70$ game which will be heavily discounted in about a month? Or how you are still paying for Spotify when you are always using Apple Music? And let's not talk about all of those beers you have been drinking out with your friends.

If you want to improve your finances, you need to carefully understand where your money is going. You can do that really easily by manually logging each purchase you make, however small it is, but the important thing is that you have to manually log it. If you use an app of the sort that automatically logs all your credit card purchases for you, then it's game over.

You will not understand how much money you are really spending. You'll lose track and well, you'll lose way more money than you probably can afford.

So, today, I want you to start putting in the work. That manual work, the work that everyone likes to skip. Manually log all your expenses and truly understand your spending habits. Then make changes to your spending habits to save more money.

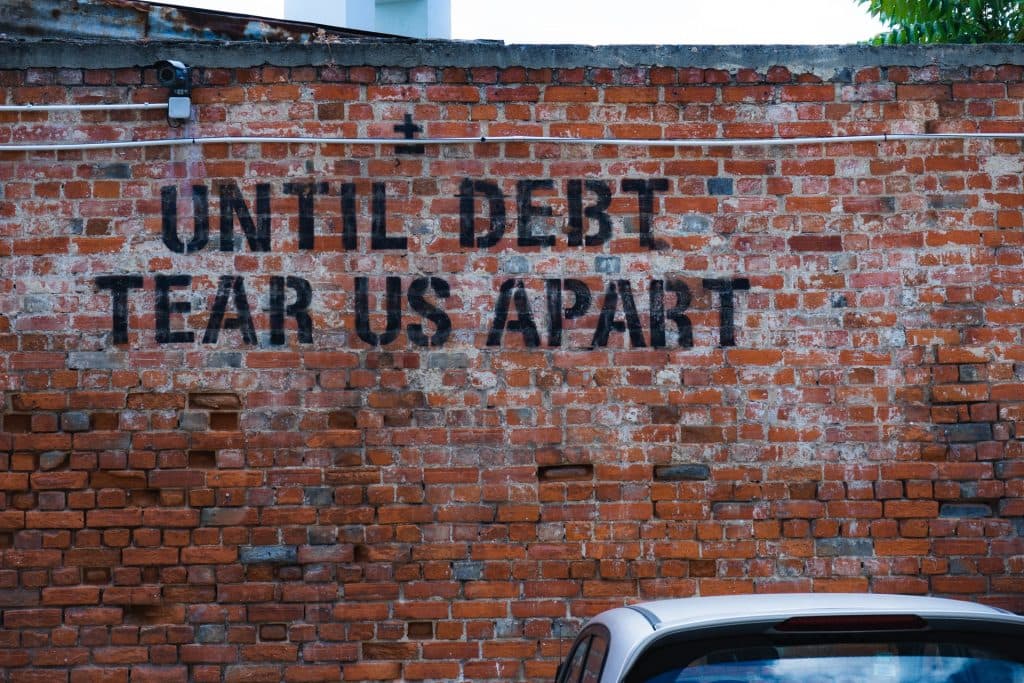

Pay Your Debts

Really, do that! If you have a credit card debt, student loan, mortgage or whatever ongoing loan you might have, always try to pay that first.

Don't let interests compound or otherwise, you will be a prisoner your entire life.

So, today, I want you to start thinking about a strategy on how you will pay off your debt. That might mean picking up an extra shift, doing some freelancing work, garage sale, whatever. Paying off a debt always should come first.

Try Investing

By investing, your money is working for you without much-needed oversight from you. Sounds great, right? Well, successful investing is quite hard cause you don't know if the company or fund or NFT whatever you are investing in will succeed. But you see, the thing is that no one really knows that.

No one can truly predict the future when it comes to investing. If someone says that you should put your money somewhere cause "it's a safe thing", in 99.9% of cases "it is not a safe thing".

So, today, I want you to do some research. I want you to take a look at a 401k from your employer. I want you to take a look at some of the best-performing index funds at the moment. I want you to take a look at the internet buzz around an up-and-coming artist and carefully consider if you want to invest in buying an NFT from that artist.